AI-driven solutions analyze telecom data—voice, digital, and financial—to identify tax savings, optimize VAT/GST, and ensure cross-border compliance. Machine learning improves forecasting, withholding accuracy, and strategic tax planning for expansion and innovation. Automation reduces manual workloads, boosting efficiency and transparency while minimizing audit risks. By aligning tax strategies with business goals, telecom providers gain compliance, agility, and financial optimization. An AI-centric tax approach is essential for competitiveness in today's rapidly evolving global telecom landscape.

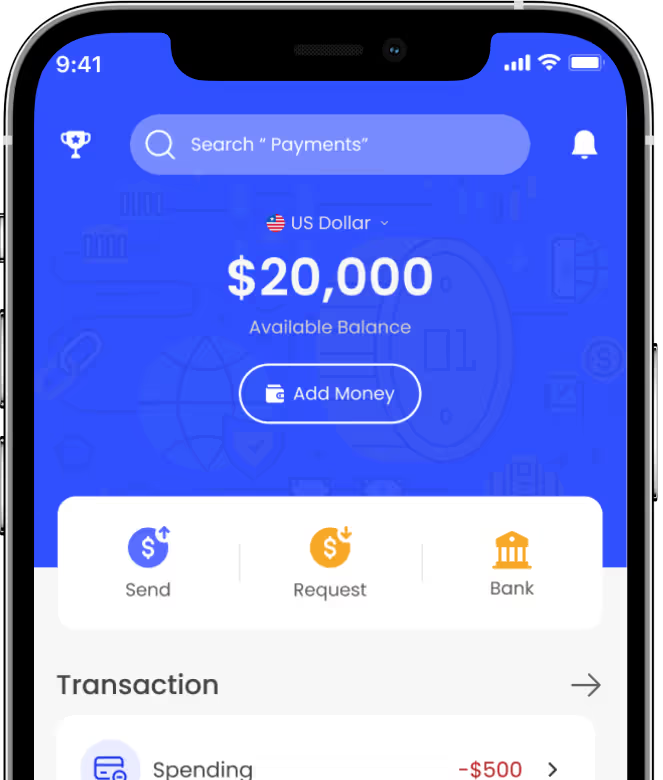

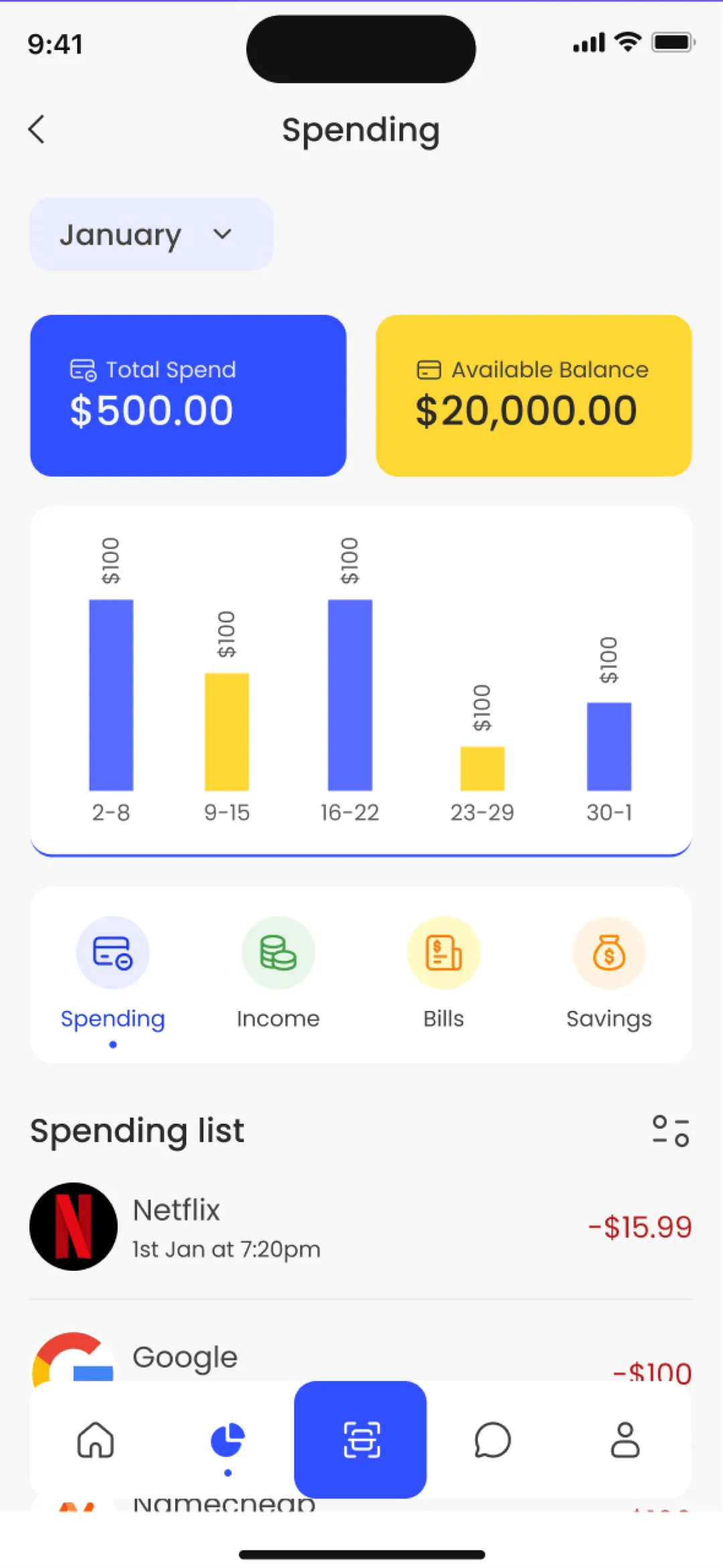

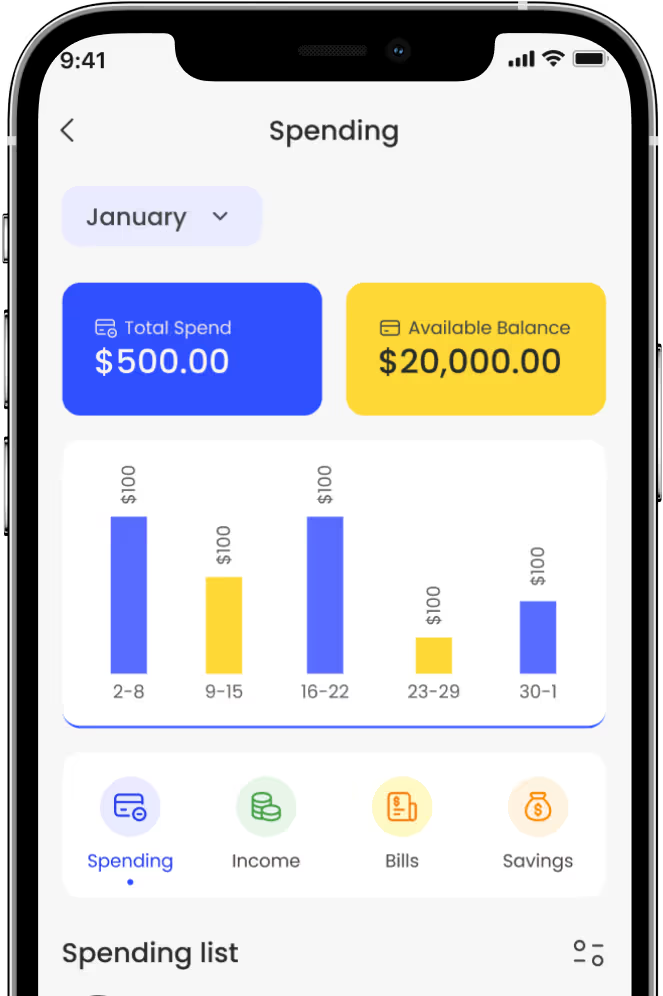

Dive deeper as we unveil enhanced features, designed to empower your financial journey further, beyond, and above.